Disclaimer: How to get started with cryptocurrency is meant to serve as a general guide and provides some insight from my personal experience of getting started with cryptocurrencies. It does not constitute financial advice. You should always seek your own professional financial advisor and do your own research before investing or trading.

How To Get Started With Cryptocurrency

You’ve been reading up on blockchain technology, you’ve heard of bitcoin and now you want to know how to get started with cryptocurrency. Well, you’ve come to the right place.

Contrary to what you may have heard, cryptocurrency is not dead and it isn’t going anywhere, that’s right folks, it’s here to stay for the long haul.

You may have been following the news, or have heard about cryptocurrency from friends or co-works, and now you want to get involved in the crypto space.

You believe in cryptocurrency technology or you want to make a quick buck, well you may have missed the boat to earn a quick buck and it’s probably not the right reason to get involved, greed, in my opinion, is the quickest way to lose everything, stay away from greed, either way nobody really knows what the future will really bring for blockchain and cryptocurrency.

My goal here is to give you a thorough breakdown to help you get started with cryptocurrency, whilst avoiding the mistakes I made when I first started.

I will cover the most important topics which I would have found useful when I first started out. Most of the info here is scattered around the net, so my goal here is to give you a one-stop shop with as much information on each topic as I can.

I will cover the following topics:

Private and public keys

What are private keys and public keys, and why they are important?

Wallets

What are cryptocurrency wallets, the different types, how to get one and how to use them?

Exchanges

What are the different types of cryptocurrency exchanges, how to get started with one securely?

Trading

Types of crypto exchanges How to start trading on cryptocurrency exchanges and the important things you need to know about exchanges

Apps

Cryptocurrency apps for price tracking, calculating of gains or losses, in local currency and different cryptocurrencies

Security

How to keep your cryptocurrency secure, best practices and how to avoid the scammers

Mistakes to avoid

Advice

Cryptocurrency advice I would have wanted when I was starting out

What is a private key in cryptocurrency

Your private key, and merely to keep things simple without all the technical jargon, is the one key you should never ever share, it allows anyone who has access to it, to gain access to all your Crypto.

The more technical description would be, a sophisticated form of cryptography, with a 256bit alphanumeric number, which is used to create a public key.

What is a public key in cryptocurrency

A public key is used to generate a wallet address which you may share to receive Crypto payments. The key you have access to from any exchange will be a public key generated wallet address.

Your private keys are what you are safeguarding when using any cryptocurrency wallet, what crypto you own is never actually stored in a wallet, it will always be stored in the relevant blockchain.

How To Get Started With Cryptocurrency Wallets

What are cryptocurrency wallets? Cryptocurrency wallets are a place to store your cryptocurrency KEYS, no actual coins are stored here, your keys allow you to move your coins on the relevant blockchain. So for example from your hardware wallet, to your online trading wallet. All your transactions will be viewable on the blockchain.

There are five main types of cryptocurrency wallets:

Hardware

Desktop

Mobile

Online

Paper

They are essentially software programs (obviously not the paper wallet) and are developed to integrate with their specific blockchain.

Thus all wallet addresses will be specific to the coins you are moving on the blockchain. Some wallets will allow you to hold one particular coin (keys), others, multiple coins (keys). Meaning, depending on the coins you are interested in, you will most likely have more than one cryptocurrency wallet.

Hardware Wallets

What is a cryptocurrency hardware wallet?

A cryptocurrency hardware wallet allows you to hold cryptocurrency private key on a physical piece of hardware, no coins are stored on any type of wallet, I would describe it as similar to a USB memory stick in size and nature, it holds your private keys and in my humble opinion, it is the safest way to store your cryptocurrency keys.

Hardware wallets may also be referred to as cold storage. Unfortunately, hardware wallets may not support every single type of token or cryptocurrency available, so you will need to do a little bit of research to figure out which currencies and tokens are supported, and which ones will be supported in the near future. The most popular options are the Ledger Nano S or the Trezor Hardware Wallet, I use a Ledger Nano S.

Desktop Wallets

What is a cryptocurrency desktop wallet?

Cryptocurrency desktop wallets are similar to hardware wallets. They are usually available from the official cryptocurrency website and are free to download. They are made by the developers of the individual currency and your private keys would be stored on your laptop or desktop.

For Ethereum you can download the official wallet from the official website: https://www.ethereum.org

There is a desktop app available for ledger hardware wallets called ledger live, your keys are still stored on the Nano S or other Ledger hardware wallet you might have, the desktop app can be used for various tasks such as checking your balance.

Mobile Wallets

What is a cryptocurrency mobile wallet?

Cryptocurrency mobile wallets are similar to desktop wallets. Mobile wallets are made specifically for your android or ios device and can hold multiple crypto keys, there are also official mobile wallets made by the cryptocurrency developers such as litecoin. Your private keys would be stored on your mobile device.

Here is the link to the official litecoin mobile wallet, known as loafwallet:

https://loafwallet.org/

Online Wallets

What is an online cryptocurrency wallet?

An online cryptocurrency wallet is the most common type of wallet available. You will automatically receive access to your own free online wallet when you sign up to any cryptocurrency exchange.

You can access this wallet through the cryptocurrency exchange application, plus you will naturally need this type of wallet if you are buying, selling or trading crypto.

I do not recommend to hold your coins on this type of wallet, ever, its use case, should only really be, for when you are actively trading, just my opinion based on a number of exchange hacks in the past. However don’t let that put you off from using an exchange, but do let it put you off from storing your coins on the exchange indefinitely.

Paper Wallets

What is a cryptocurrency paper wallet?

A paper cryptocurrency wallet allows you to have a print out of your private keys and public keys on a piece of printed paper it may also have a QR code generated for ease of use.

If you lose your paper cryptocurrency print out you lose access to your cryptocurrency forever. This is also a method of cold storage.

How to get a Crypto wallet

Your first wallet will most likely be one provided by an exchange. In the first instance, you will need an exchange that deals with converting your hard earned day to day local currency into a cryptocurrency, this will usually be in the form of Bitcoin, Litecoin or Ethereum. It will allow you to buy, sell and trade cryptocurrency. To get your first online cryptocurrency wallet Click this link to get started with Coinbase. If you get started with £100 or more we will both receive the same bonus for using the link provided.

Quick tip, it is cheaper to send across a wire transfer to coinbase then pay with a credit or debit card. Before I was committed to sending a wire transfer I used my credit card, just to be double sure it was legit. It was, however, I would still recommend you start the same way for your own piece of mind.

How to use a cryptocurrency wallet

It’s worthwhile noting that your exchange wallet keys are public and you do not have access to the private keys. This is so that the exchange can hold your private keys in cold storage to minimize losses in case of a hack.

After you have purchased your first bit of crypto through coinbase, you will find an accounts tab at the bottom of the coinbase app screen. I have circled it for you below.

Next, you will need to hit the QR code button inside your wallet, it is located at the top of the screen

Once you hit that button a popup box will appear, with a button which says “Show Address” hit that button.

From here you can copy the address by hitting the “Copy address” button. That long number under the QR code is your public wallet address. Each wallet will have its own unique address.

All crypto wallets are specifically designed for each individual cryptocurrency

All crypto wallets are specific to each cryptocurrency. Meaning you cannot send different coins to different wallets. Ethereum can only be sent to an Ethereum wallet address. Should you make the mistake of sending your Ethereum to a bitcoin address you will most likely lose your coins (keys) forever.

However, there is one exception – ERC-20 tokens

Prior to coins having their own blockchain and some may not yet or ever have one, they will have to be based on a particular blockchain protocol. ERC-20 tokens are one such example. With ERC-20 tokens, you could store all your token keys on one ERC-20 wallet. They are all generated from the Ethereum blockchain. Meaning you could send multiple ERC-20 tokens to your Ethereum wallet by using a website such as MyEtherWallet.com.

It is important that you always make sure the site you are visiting is the actual MyEtherWallet.com website. There are a load of sites popping up with similar URLs, with a goal to trick you into sending your coins to them, losing your coins forever. Stay away from search engines and enter the URL straight into your browser, use bookmarks. If you use chrome there is a dedicated app available for MyEtherWallet.

How To Get Started With Cryptocurrency Exchanges

What are the different types of cryptocurrency exchanges

There are two main types of cryptocurrency exchanges, the most common convert your local currency into crypto. And the others, allow you to convert crypto into other cryptocurrencies, also known as “altcoins” (if it’s not bitcoin it’s usually classified as an altcoin meaning alternative coin).

There are a number of different exchanges you can start with. The most popular one is Coinbase, which is how I started.

Coinbase allows you to buy, sell and trade Bitcoin, Ethereum, Litecoin, Bitcoin Cash and more recently it has added Ethereum classic to the mix. You may have also seen a lot of adverts for etoro, in my opinion, this is the second most popular exchange in the UK. I don’t have any preference as such.

If you are planning on starting out in crypto, then my link below will give you and I an extra $10 worth of crypto (yes the bonus is calculated against USD, but that’s fine as you receive it in the form of bitcoin). You don’t have to use this link, but you will not get the bonus without it.

Altcoin Exchanges

There are a multitude of Altcoin exchanges, more than 100 and rising all the time. So which one is right for you? I have tried a lot of them, and for me, the safest and easiest to use would be binance. This is my personal opinion and recommendation. I like that it has a desktop app, a phone app and you can gain access from your web browser also.

How To Get Started With Cryptocurrency Trading

Now that you have an idea of how wallets work and the different types of exchanges, I want to give you my own personal insights on how to get started with cryptocurrency trading, as well as common mistakes to avoid.

The first is to decide what you are trading for. Are you trading to increase your original investment in your local currency? Or are you trading to increase your Bitcoin or Ethereum Stack?

The second is, this market is global and it never sleeps, it is open 24/7!

From what I have seen, everything is linked to Bitcoin. If Bitcoin crashes all the other altcoins follow suit.

There is zero regulation in Crypto, so be very cautious, especially if you’re going to use a very small exchange.

The market is extremely volatile and thus very risky.

On an exchange such as coinbase, you will use local currency to purchase crypto, then you will trade your crypto against the local currency. So for example, hypothetically you might purchase 1ETH for £100. If ether goes up to £200 and you decide to sell the 1 ether you have, then your return is £200. Thus your return not including fees is 100%.

You do not have to purchase one whole Ether, you can purchase various denominations known as Wei. 1 Wei = 0.000000000000000001 ETH (no exchange will sell you 1 Wei, it’s probably not worth a penny, and it wouldn’t be worth sending that amount to anyone, so the Ether blockchain would probably reject your transaction.) At the time of writing, 0.1 Ether would cost you £22.83, this denomination is purchasable at this time.

How To Get Started With Cryptocurrency Trading Pairs

Trading pairs on ALT coin exchanges

In my opinion, there are only 3 trading pairs you should be aware of on ALT exchanges at this early stage These are Bitcoin (BTC), Ether (ETH) and Tether (USDT). This is because these three coins can be used to enter and trade with on altcoin exchanges.

This part is important, if you are trading altcoins, you should avoid, at all costs, comparing the USD value to the altcoin (hear me out here). Why? You say, well, it’s the quickest way to end up broke. Let me give you an example, I will use the earlier Ether example here.

Why you should avoid USD prices when trading altcoins

So you have purchased one ether for £100, and now you want to purchase an altcoin, for arguments sake let’s assume you have done your own research (this is important, always do your own research when putting your hard earned money down for anything), and you decide that you would like to purchase SUB (it’s an altcoin, full disclosure I own SUB), you are now purchasing SUB against the price of ethereum. So the trading pair would be SUB/ETH.

Now here’s where it gets interesting, for argument’s sake, let’s say, for one ETH you were able to receive 2000 SUB. And the value of ETH, which you originally purchased for £100 is now worth £200, you might not be in the money yet, because this does not mean the value of your SUB is worth £200, no it does not.

What matters to you in this scenario, is what your SUB is worth against the ether, so to delve in a little further and show you why this is a dangerous way to play this market, I will elaborate. In this example, the 2000 SUB you have is now worth 0.25 ether, not 1 whole Ether, so whilst Ether has gone up in value, your 2000 SUB has actually gone down, meaning the 2000 SUB you own is now worth only 0.25 ether, that ether, even though it has doubled in value, is only worth £50 if you sell your SUB for Ether. You’re down 50%. Because you have less Ether.

In the above example, the ether price would have to increase another 100% to £400 for you to even break even. Not good! So keep it simple when trading on an ALT exchange, especially when you are getting started, trade to increase your BTC or ETH stack, not your £ or $ value on the ALT exchanges.

The USDT option

Now, with the above example in mind, there is an alternative here, and that is dependent on if there happens to be a Tether (USDT) pairing against your ALT coin.

You see USDT is supposedly based on USD, where 1 USDT is supposed to be worth 1 dollar. BTC, ETH, LTC all have USDT trading pairs on most ALT exchanges, Binance has a lot more (but not SUB yet).

So what’s the point of USDT? Well USDT is used as a stable coin to get out of your altcoin or bitcoin holdings when the market is crashing or at a high. So, if you were to send your ether across to Binance to purchase SUB, but before you get the chance to buy SUB, the value of ether rises let’s say to £300, then you could potentially exchange your ETH for USDT, meaning you have now locked in the rise of the price of Ether.

Should Ether go down to the original price you paid (£100), after you have traded it for USDT, then you could repurchase Ether meaning you have almost tripled your Ether stack, get it?

Cryptocurrency trading

On Coinbase you have two options, buy, or sell. However, on Binance you have three options, Limit Trade, Market Trade, or Stop Limit.

Limit Trading allows you to set your price to buy or sell, you can also set the number of Alt coins or tokens you wish to purchase. Just because you set a limit trade it does not mean your trade will be fulfilled. The supply and demand must be met. Meaning part of your order may go through until someone else is willing to buy or sell at the price you have set.

Market Trading allows you to buy or sell at the current market price, this does not mean you are guaranteed your whole order to go through at the current price, if your order is larger then what is being offered then the price can fluctuate until your order has been dealt.

A Stop Limit. When the current price reaches the given stop price, the stop-limit order is executed to buy or sell at the limit price or better.

How To Get Started With Cryptocurrency Apps

Apps to help manage your portfolio

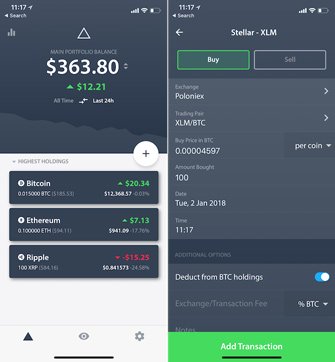

When I first started it was all about excel, that was until I discovered blockfolio, and I still have blockfolio today, but have since moved on to using Delta to track my portfolio. I keep blockfolio because it has a news section which I like to read. And it pings me specific news on coins I hold or have an interest in.

However, all my transactions are all recorded on Delta. There is a free version of the app which allows you to sync the Delta app with two exchanges. If you wish to buy coins that are on other exchanges (meaning more than the two you have synced with) then you could either enter the details manually or purchase the premium version of the app.

I personally manually add any additional coins outside of binance and coinbase and I highly recommend you do too. The cost of the premium version of delta is far too high, it’s not their fault arguably and according to them. I believe they are trying to turn to a profit as fast as possible and have a multitude of fees to pay such as the rip off fees that apple charge on the apple app store. Saying that it’s still far too high for the average Joe to justify the price.

You can find out more about delta using the following URL:

https://getdelta.io/

How to keep your cryptocurrency secure

There are two apps I use to increase my security when accessing an exchange. One is Google Authenticator and the other is Authy. You don’t need both, Authy will do just fine.

They both allow two-factor authentication and are a must-have in my opinion. Remember you are never ever 100% secure with any tech, these are just added onion layers to your security. So the first thing you should do after joining an exchange is to activate the 2FA option. This option is usually found in the settings.

Authenticator and Authy offer a time-sensitive 6 digit code to access your account, so even if your username and password are compromised you will still have an added layer of security.

Cryptocurrency mistakes to avoid

For me my number 1 mistake was not double checking the decimal places, so I thought I was purchasing 1.1 Eth worth of one particular altcoin, when in fact it was 1.01, not a huge error, but it’s safe to say that it could have been much, much, worse. So double check the figures, all the extra zeros can get confusing and will take a bit of time to get used to.

I have not personally made the mistake of sending coins to the wrong coin address, but it is a common mistake, remember Ether can only be sent to an Ether address, if it is sent to any other address your Ether will most likely be lost forever, make sure you triple check the address you are sending to.

Cryptocurrency advice

- Buying cryptocurrency with the premise that it will rise in value is speculating, it’s not investing

A lot of the coins you may have heard of or read about do not have working products, what that means in reality, is that you are not investing, you are in fact speculating. Investing is something completely different, investing, and this is my opinion, is picking a working product that produces a profit.

2. “Invest what you can afford to lose”

You may have read this in multiple places, and because of the above point, it is a speculative buy, which is why you hear this over and over again. So, by all means, speculate hoping for the best but be prepared for the worse.

3. Heavy manipulation happens in this market all the time

FOMO or fear of missing out is a by-product of a disease called greed. That coin you wanted is rising, and it’s not coming down, it’s just gone up 60% what do you do, FOMO will kick in and you’ll want to part with your money. Don’t, these markets can be heavily manipulated, and the chances are the second you buy the price will rocket down to earth.

4. You cannot time the market

Trying to buy coins at exactly the right time, where you are watching a graph hoping to buy it just as it hits the bottom and then watch it rise as you make 100% profit, if you get it right then you’re quid’s in, however, it’s reliant on luck. It’s highly unlikely you will be able to time the market perfectly, so make an informed decision or pick a price and set a buy order for the price you are happy with, its likely that the price may go way below where you think it has bottomed out, the way to overcome this is dollar cost averaging. So basically continuing to buy on the dip.

5. Buy low and sell high, or just Hodl and hope the tech will eventually be adopted in the mainstream

Hodl is a well-known term in the crypto markets, it was originally a typo on a crypto forum and since it has become an ongoing meme, it stands for hold. Meaning do not buy high and sell low, just hodl your coins with the hope they will rise (speculating, see?). From a day trading point of view, it’s probably the wrong strategy. However, if you are a day trader you would be the one with the skills and knowledge of trading and reading charts. If you are a speculative buyer then you just buy and hodl, when the price goes down you make the most of dollar cost averaging by buying the dip.

6. Buy on the dip

The most recent bull market has meant the dip has often kept dipping, you see no one really knows where the price is going, but you will see patterns, where a coin price increases so much that eventually it will dip, also known as a market correction.

7. Diversification

There are a close to 2000 coins available today according to coinmarketcap, so you’ll have to understand the differences in their usecases. Whilst Bitcoin is a currency and known to be a store of value, ethereum is a smart contract platform. Here are a few different types of coins available and where they sit in their ecosystems (I own some of them):

Currency

Bitcoin, Bitcoin cash, Litecoin, DASH (hybrid), Verge (hybrid), Zcash, (hybrid)

Privacy coins

Monero, Bytecoin, DASH (hybrid), Verge (hybrid), Zcash (hybrid)

Platforms/Smart contracts

Ethereum, EOS, Stellar, Cardano, NEO, TRON, NEM, Ethereum Classic

Ecosystems

Ark

Exchange

Binance Coin, BitShares

Gaming

Decentraland

Social network

ReddCoin

Data storage

Storj

Cloud computing

SONM

Hosting

Substratum

8. Do your own research

Everyone online will shill coins they own, what’s shilling you ask? It’s where you promote the coins you own, do not buy any coins that you haven’t done your own research on.

- Go to the official website, every coin has one you can find the correct link by using coinmarketcap.com (see below)

- Read the white paper

- Take a look at the team (Are they real)

- Think about the tech they are planning to launch, is there an actual use case? Does it solve a real-life problem

- Are they active on GitHub

- Are they hitting their milestones

- Do they have an active community where they participate

9. Visit coinmarketcap

It should be on your go-to list, all listed coins are found on coinmarketcap.com, and this is the site that all exchanges use to collaborate with. This is where you can look at a coin’s history and is the best place to go if you are looking for the official website for the coin you have an interest in.

10. Keep your coins on a hardware wallet

Exchanges have been hacked, so I use a Ledger Nano S to keep my coins safe, the following link will take you to the official Ledger site. The Nano S can integrate with chrome, it has a desktop app with a mobile app on the way.

11. Get started with coinbase

Get $10 worth of bitcoin when you sign up to coinbase using my ref link below and purchase your first bit of crypto Use this link to get your Coinbase bonus. If you wish to buy alt coins then purchase etherum or bitcoin so you can easily make trades on binance.

12. Binance is my Altcoin exchange of choice

If you own binance coin (BNB) you will get a discount for every trade you make. It has saved me on fees when buying or selling altcoins. Use this link to get started with binance.